Category: VAT

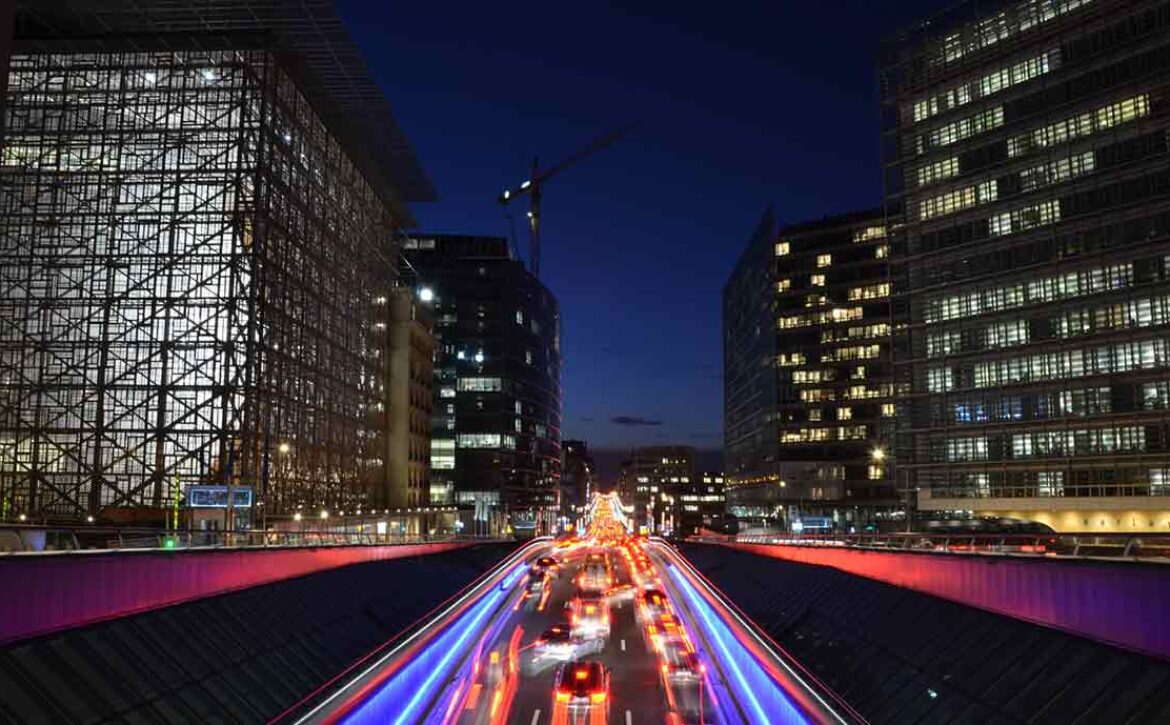

How automation can support cross-border growth

In a $1 trillion dollar market, shipping cross-border requires three crucial elements for successful growth:

- Effectively managing transactions

- Compliance

- Customer delight

While the growth rate of cross-border trade is expected to outpace ecommerce twice over, making sure all three are aligned is one of the biggest pain points facing ambitious businesses today.

Speaking at eTail Germany, one of Europe’s largest conferences dedicated to businesses seeking global expansion, Patrick Frith, Director of Cross-border Global Trade, Avalara said: “For any business thinking about selling anywhere in the world, the single biggest headache they face is how they can move their products from one place to another in a way that keeps them compliant with the financial obligations of each market. It’s no surprise that despite the desire to grow, the complexities of international expansion can cause a lot of uncertainty.”.

A surge of changes across the global compliance sector has seen a seismic shift in new compliance codes and reporting requirements. One notably is the update to the Harmonised System (HS) tariff codes which came into play at the start of 2022 resulting in the removal of 870 codes and an addition of 940. Country specific, HS Codes are a system to classify globally traded products. Used to calculate customs duty, each country has a unique code for the same product – so getting it wrong will impact your business and your bottom line.

Frith continues: “Given the growth rate of the market, if you’re not already shipping internationally, now is the time to consider cross-border trade. The opportunity for expansion is enormous. If the notion of navigating some of these known challenges feels overwhelming, please be assured that there are solutions to help. Technology has developed enormously over the last decade – utilised by thousands of businesses across the globe, it’s a proven means to help navigate around potential pitfalls – meaning you can keep focused on growing your business.”.

Partners can provide you with real-time calculations, support, and advice on everything you need to keep your goods moving across the globe.

If you’re ready to find out more, contact us to speak to one of our experts for a no-obligation discussion on how we can help.

Top 10 special territories for VAT purposes

VAT is generally levied around the globe at a federal/country level. However, there are many sovereign states, provinces, territories, regions and discreet areas that have special rules for VAT purposes. Here we have set out our top 10 special territories to look out for and pay careful attention to.

1. Northern Ireland

Northern Ireland is located in the northeast of the island of Ireland and shares a border to the south and west with the Republic of Ireland. It is part of the United Kingdom and within the scope of the UK’s VAT system. However, following Brexit and under the terms of the Northern Ireland Protocol, Northern Ireland is treated as part of the European Union (EU) for VAT and customs purposes solely in relation to goods. While the customs situation is quite complex and fluid, some of the key VAT implications are:

- Sales of goods between Great Britain and Northern Ireland are subject to UK VAT (technically this is an export and “import VAT” is invoiced, but in practice UK VAT is charged and collected like any normal domestic sale)

- Supplies of B2B goods between Northern Ireland and the 27 EU member states (and vice-versa) are treated as intra-community dispatches (subject to acquisition VAT by the customer in its VAT return)

- Supplies of B2C goods from Northern Ireland to consumers in the EU can be reported on the “One-Stop-Shop”

- Supplies of low value goods shipped from outside of the EU (including Great Britain) sold to Northern Ireland consumers can be reported under the Import One Stop Shop (IOSS).

2. Vatican City

Vatican City is an independent city-state and enclave located within Rome, Italy. Also known simply as the Vatican, it is the smallest sovereign state in the world, became independent from Italy in 1929 and is a distinct territory under the ownership, authority and jurisdiction of the “Holy See”. The Vatican City is outside the scope of Italy and the EU for VAT and customs purposes. As such, Italian VAT is not applicable in Vatican City.

3. Monaco

The Principality of Monaco is a sovereign city-state on the French Riviera. Monaco uses the Euro as its sole currency but is not a member of the EU. Monaco is treated as being part of the territory of France for VAT and customs and excise purposes. As such, VAT is levied in Monaco on the same basis and at the same rate as in France.

4. San-Marino

The Republic of San Marino is a small county in Southern Europe enclaved by Italy. It is treated as within the territory of Italy for customs and excise purposes but outside the scope of Italy and the EU for VAT purposes. San Marino has its own “import tax or single-stage tax” on goods and related services imported to San Marino by businesses – this is chargeable at 17%. Starting from July 1, 2022, it will be mandatory for Italian taxpayers to issue electronic invoices to customers in San Marino via the SDI platform.

5. The Canary Islands

The Canary Islands or “the Canaries”, as they are known informally, are a Spanish archipelago in the Atlantic Ocean. The eight main islands are Tenerife, Fuerteventura, Gran Canaria, Lanzarote, La Palma, La Gomera, El Hierro and La Graciosa. They are autonomous communities of Spain. However, while the Canary Islands are part of the EU for customs purposes, they are outside of Spain and the EU for VAT purposes. Instead of applying Spanish VAT, there is a local Sales Tax called “Impuesto General Indirecto Canario” (IGIC) in the Canaries with a standard rate of 7%, a higher rate of 13.5%, and a reduced tax rate of 3% (with a zero rate for certain basic need products and services). The Canary Islands also recently introduced IGIC real-time invoice reporting requirements under the Suministro Inmediato de Informacion (‘SII’).

6. Lake Lugano

Lake Lugano is a glacial lake situated on the border between southern Switzerland and northern Italy. The lake is named after the city of Lugano and is between Lake Como and Lago Maggiore. With effect, January 1, 2020, the Italian municipality of Campione d’Italia and the Italian waters of Lake Lugano are now included in the EU customs territory. However, Campione d’Italia remains outside the scope of Italian VAT and the EU VAT area. As such, Italy and Switzerland have agreed to introduce a local consumption tax in Campione d’Italia that is aligned with the Swiss VAT rates to ensure a level playing field.

7. The Channel Islands

The Channel Islands are an archipelago in the English Channel, off the French coast of Normandy. The Channel Islands include two Crown Dependencies, Jersey and Guernsey. They are not part of the UK but the UK is responsible for the islands’ defense and international relations. The Channel Islands are outside the scope of UK VAT but Jersey has a GST which is chargeable at 5%. Guernsey currently has no VAT system but has recently proposed the introduction of a GST in the future.

8. Faroe Islands

The Faroe Islands just the “Faroes” are a North Atlantic archipelago located north-northwest of Scotland and halfway between Norway and Iceland. Like Greenland, it is an autonomous territory of Denmark but outside the scope of Danish VAT. The Faroe Island does however have its own local VAT, which in Faroese is called “Meirvirðirgjald” (MVG).

9. Isle of Man

The Isle of Man is an island in the Irish Sea, off the coast of Great Britain. It is an internally self-governing dependency of the British Crown and its people are British citizens. However, the Isle of Man is not, and never has been, part of the UK nor is it part of the EU. There is a common tax area between the two countries resulting from an agreement between the UK and the IOM governments. The spirit of the agreement between the UK and the IOM is that IOM legislation will continue to generally mirror UK legislation and procedures, so maintaining a customs union and common indirect tax area. Isle of Man Customs & Excise administer VAT locally, although they are required to follow and implement UK policy and practices.

10. Lichtenstein

The Principality of Liechtenstein is a German-speaking microstate located in the Alps between Austria and Switzerland. It has a customs and monetary union with Switzerland and is part of Switzerland for VAT purposes. As such, Swiss VAT is levied on goods and services in Lichtenstein, but the tax is administered locally.

Businesses that have customers in the above territories should ensure that they are correctly accounting for the right rate of VAT on sales. This may involve setting up custom tax calculation policies in their ERP, ecommerce platform or tax engine based on more granular address data.

Speak to one of our experts to discuss how Horizon Solutions can assist with correct tax rate determination

- 1

- 2